It’s hard to believe that just fifteen months ago, the retail real estate industry – every industry, really – was thrown into chaos by the onset of Covid-19. Regulations updated and changed almost faster than we could keep up with, and businesses had to either adapt in the blink of an eye or close their doors indefinitely. While there was certainly no playbook for how this situation would unfold, we felt that the lessons learned from the Great Recession could serve as a guide.

With that in mind, last year, we published our thoughts on six ways retail real estate would change in a post-Covid world. Now we’re going to revisit that post and take a deeper dive into what we got right and what we might have missed.

Theory #1: The suburbs will likely recover quicker.

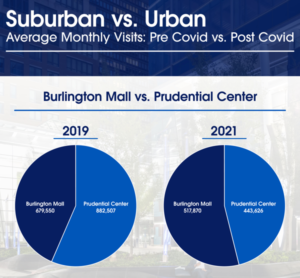

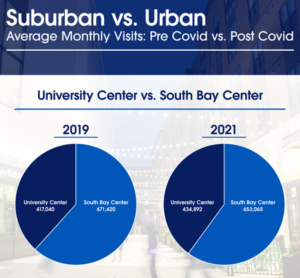

The suburbs recovering quickly, we’re happy to say, has proved mostly true. Most of our brokers will tell you that suburban retail real estate activity only took a few months early in the pandemic for things to stabilize as retailers learned to adapt to the new rules of the game. Today we’re seeing steady activity across all nine of our offices at levels matching or even exceeding those of 2019, with both increased tenant activity on our listings, as well as our tenant clients actively seeking opportunities.

While we have seemed to turn a corner with urban real estate, however, it still isn’t quite back to where it used to be. With a rise in the number of people working from home, reduced traffic from tourism, and a reluctance to use public transportation, urban centers saw much lower foot traffic for daytime spending and incidental shopping.

In urban areas, brighter days are certainly on the horizon though. According to Joe Mastromonaco ‒ Partner, New York City, “While the rents are not back to their pre-Covid levels, brands, digital concepts, and restaurants all know that New York is the greatest city in the world, and this situation has created more affordable price-point options than any time in the last decade.”

Verdict: True

Theory #2: Users with the most effective mobile ordering apps who are best able to execute for their customers will win.

When we wrote this prediction, we mainly had fast casual restaurants in mind. At this point, fast casual restaurants that don’t have either a mobile app, a drive-thru, or both aren’t even in the conversation. Meanwhile, chains like Chipotle and Starbucks saw substantial increases in digital orders over the past year and are now leveraging their rewards program to hold onto those gains. Be on the lookout for a future post where we do a deeper dive on how the restaurant industry has reacted to Covid-19.

We’ve even seen this trend expand beyond restaurants, with retailers like Target, Walmart, and Home Depot making their BOPIS (buy-online pick-up in store) experience even easier for customers through use of their mobile apps. According to a McKinsey study, nearly 40% of Americans tried a new way of shopping during the pandemic and 75% of those who tried curbside or BOPIS wish to continue shopping that way post-Covid.

Verdict: True

Theory #3: Restrictive municipalities will likely loosen permitting.

We made this prediction assuming we’d see massive vacancies that haven’t come to fruition outside of urban areas. Vacancies that do exist are either flawed or haven’t been vacant long enough to cause panic and significantly change permitting yet. Spaces are still being filled with plenty of active users.

What we did see was a shift in permitting in expanded outdoor dining and revised liquor laws with the implementation of drinks to go in many establishments. While we cannot point to specific instances of permitting authorities shifting attitudes towards drive-through, the CDC’s decision to declare drive-throughs as “essential” certainly lends more weight to the argument.

We asked Josh Swerling, a Principal at Bohler in Southborough, MA to weigh in. “Though we haven’t seen complete revamping of zoning or land use regulations related to drive-throughs (yet at least), we have seen more jurisdictional agencies and municipal boards showing empathy and a more open-minded approach to the operational needs of our QSR (quick serve restaurant) clients as we navigate the entitlement process,” says Swerling.

“This includes either new ground-up facilities or modifications to existing drive-through facilities to accommodate the addition of lanes, order/delivery points, mobile ordering, uber eats/door dash and curbside pickup options.”

Verdict: Too soon to tell

Theory #4: Even healthy regional malls will sustain irreparable damage.

Lousy malls pre-pandemic are still lousy malls today. Good malls are hanging around better than we expected as of this time last year. We’ve seen re-development continue and even accelerate in some instances, but we can’t point to any malls in the markets we cover for whom Covid was the final death blow.

When making this claim, we anticipated that the operational restrictions, particularly on enclosed shopping centers, would be simply too much for already beleaguered malls to handle. Not that we are rooting for their demise, but mall-based tenants (as we have noted before) make up such a large portion of the flawed “retail apocalypse” narrative. The faster we can all move on from these struggling concepts and embrace the new realities of our quite healthy industry, the better off those us so closely tied to retail real estate will be.

Verdict: False, unfortunately

Theory #5: Anchor tenants will relax use restrictions to avoid heavy vacancies in centers.

Even at the time of writing our original predictions, we were already starting to see this come to pass as retailers and landlords worked through rent deferrals. However, this was a trend we saw pre-Covid and has more to do with the changing user pool for retail space than any changes brought about by the pandemic.

Similar to Theory #3, this prediction was rooted in the belief that our industry would be facing an existential crisis and massive tenant failures brought on by Covid restrictions. For this reason, we’re quite happy to be wrong. Retailers and landlords worked together at a rapid pace to react to Covid changes. When coupled with the broader stabilization efforts of the economy, more drastic measures thankfully were not needed.

Verdict: False (and we’re good with that)

Theory #6: Medical users will continue to be a major player for retail assets.

This is another prediction we haven’t yet seen realized, mostly because medical users paused expansion during Covid. However, certain medical users, such as urgent care and well-visit service providers are back to pre-Covid levels of activity.

What we have not yet seen is how regional healthcare providers are going to shift strategies in response to challenges from Covid. We expect it will take some considerable time and distance from the crisis for medical users to take stock of what has passed and make strategic adjustments.

Verdict: Too soon to tell

As we noted, there was no playbook for what we all experienced over the past 15+ months. With the benefit of hindsight, here are a few other important impacts we’ve seen.

So what did we miss?

While the run on toilet-paper bordered on comical, it did signal broader supply chain challenges faced by retailers, wholesalers, and manufacturers as a result of the pandemic. Anyone who tried to build a deck on their home this year can tell you not only about the wait on pressure-treated lumber but the resulting price hikes. These shortages were brought on not just by increased demand but by the logistical challenges of travelling across jurisdictions and plant shutdowns due to Covid outbreaks. How did this impact real estate? For starters, it made projects more expensive and time-consuming to construct. Higher material costs and work-stoppages were a constant thorn in developers’ sides as they worked to move projects to completion.

All this was compounded by the fact that retail demand never really waned the way it did during the Great Recession, as Covid did not bring with it an economic collapse. This was partially due to stimulus at the lower end of the economy and work-from-home technology at the upper end. While it’s true that some industries – restaurant and hospitality, to name a couple of examples – suffered devastating losses, the rest of retail remained strong, if changed. In fact, certain sectors such as grocery and home improvement saw record sales putting them in a much stronger position to succeed post-Covid.

Fifteen months ago, all industries were staring into the abyss. For the last several years, the trend in retail real estate was placemaking: not just about shopping but creating venues and center where people would gather simply to connect. For that reason, you’d be forgiven for thinking that retail real estate would be forever altered. However, the activity we are seeing with our teams now, the appetite for transactions, is almost indistinguishable from that of 2019 (save people wearing masks and keeping their distance). If we’re being honest, not many among us would have guessed that an industry built around the gathering of people would have recovered so well, so quickly. In that sense, this crisis has highlighted the resilience of the retail industry to weather all kinds of challenges.

What’s next?

Frankly, it’s still too early for many of our thoughts to materialize. We modeled our predictions based both on the most up-to-date industry information at the time and the template of the Great Recession. But so much of the fallout from the latter took years to fully play out, only really apparent around 2015.

When we wrote our initial predictions in May 2020, we weren’t quite back to normal transaction levels yet; everything was very much paused. By the end of the summer, nearly all our clients were back and hungry for deals, able to adjust to the shifting real estate landscape to continue or even accelerate their growth plans.

What we knew then still holds true now: the landscape of retail real estate continues to shift, with new users joining leading retailers able to quickly adapt to changing customer demands, but brick & mortar isn’t going anywhere anytime soon.